XRP Price USD: How Its Market Capitalization Impacts Its Value

XRP, a digital asset powered by the Ripple blockchain, has gained significant attention in the cryptocurrency space due to its focus on enabling fast, low-cost international payments. As an alternative to traditional financial systems, XRP’s unique features and widespread adoption have attracted investors, traders, and financial institutions alike. One of the key factors influencing XRP’s value is its market capitalization, which plays a crucial role in determining its price, particularly when measured against the U.S. Dollar (USD).

This article explores how XRP’s market capitalization impacts its price in USD, analyzing the various factors at play and offering insights into how investors can better understand its value.

What Is XRP and How Does It Work?

Before diving into the relationship between market capitalization and XRP price USDT, it’s important to understand what XRP is and how it operates within the broader crypto ecosystem.

Understanding XRP and Ripple

XRP is a cryptocurrency designed for facilitating fast and low-cost cross-border payments. It is the native digital asset of the Ripple network, a decentralized blockchain platform. Unlike Bitcoin or Ethereum, Ripple’s primary focus is on serving financial institutions, enabling them to make real-time international transfers with minimal fees.

Ripple Labs, the company behind the Ripple network, developed XRP to provide a reliable bridge currency for remittance networks and financial institutions. This focus on the financial sector gives XRP a unique standing among other cryptocurrencies, as it is often seen as a potential tool for revolutionizing international finance.

Ripple’s Role in the Financial Industry

Ripple provides payment solutions such as xCurrent, xRapid, and xVia to streamline cross-border transactions. Many banks and financial organizations use Ripple’s technology to settle payments quickly, making XRP an integral part of a rapidly changing financial landscape.

The Concept of Market Capitalization in Cryptocurrency

Market capitalization is a widely used metric to measure the overall value of a cryptocurrency. It is calculated by multiplying the total circulating supply of a cryptocurrency by its current price. In the case of XRP, the market capitalization is determined by the number of XRP tokens in circulation multiplied by the current price of one unit of XRP.

For example, if there are 100 billion XRP tokens in circulation, and the current price of one XRP is $0.50, then the total market capitalization would be: Market Capitalization=100,000,000,000×0.50=50,000,000,000 USD\text{Market Capitalization} = 100,000,000,000 \times 0.50 = 50,000,000,000 \, \text{USD}Market Capitalization=100,000,000,000×0.50=50,000,000,000USD

Market capitalization serves as an indicator of a cryptocurrency’s size in the market. Higher market capitalization typically suggests a larger, more established cryptocurrency, while smaller market capitalization can indicate a more volatile or newer asset.

How Market Capitalization Affects XRP Price

Market capitalization plays a vital role in determining the price of XRP, but it’s important to remember that the relationship between the two is not always linear. A cryptocurrency’s price can fluctuate even with a stable or increasing market cap due to various external factors.

Supply and Demand Dynamics

One of the key drivers of XRP price is the basic principle of supply and demand. If demand for XRP increases due to a surge in adoption by financial institutions or increased speculation by investors, the price of XRP will likely rise, leading to a higher market capitalization. Conversely, if demand decreases, the price may fall, and the market cap will shrink.

In the case of XRP, the supply is pre-mined, meaning there is a fixed maximum number of XRP tokens that can ever be in circulation. As of now, over 100 billion XRP tokens have been issued, with a significant portion held in escrow to prevent flooding the market with too much supply.

Liquidity and Market Depth

The liquidity of a cryptocurrency refers to how easily it can be bought or sold without causing significant price changes. A larger market capitalization often means better liquidity, which can result in more stable pricing.

Since XRP is one of the top cryptocurrencies by market capitalization, it tends to have high liquidity. This helps ensure that the price remains relatively stable in times of large trades, making it attractive for institutional investors looking to invest in a large-cap asset with minimal slippage.

How XRP Price is Affected by Market Sentiment

Market sentiment can heavily influence the price of XRP. Investor perceptions, news, and global financial events can create fluctuations in price, even if market capitalization remains constant. For instance, if a major financial institution announces that it will use XRP for cross-border payments, the positive sentiment may drive up the price.

On the other hand, regulatory uncertainty, security concerns, or unfavorable news can cause the price to dip, affecting the overall market capitalization. For example, if governments or financial regulators impose harsh regulations on XRP, this could result in lower demand, causing the price to drop and subsequently lowering its market cap.

XRP Price USD vs. XRP Price USDT

The value of XRP is often quoted in terms of USD or Tether (USDT), a stablecoin pegged to the U.S. Dollar. Understanding how XRP price in USDT affects its market capitalization is crucial for traders and investors. USDT is commonly used in cryptocurrency markets as a stable asset, and it often serves as a trading pair for XRP in exchanges.

While the price of XRP in USD gives a clear indication of its value in fiat currency, the XRP price in USDT can provide a more accurate reflection of the token’s performance within the crypto ecosystem. Since USDT is less volatile compared to other cryptocurrencies, it offers a stable benchmark for XRP’s performance in the market.

The Role of Market Capitalization in Long-Term Price Trends

Market capitalization plays a central role in assessing the long-term viability of XRP. A high market cap signifies strong demand and widespread acceptance, which can lead to sustained price growth. However, it’s essential to consider other factors like market adoption, network upgrades, regulatory clarity, and broader economic trends.

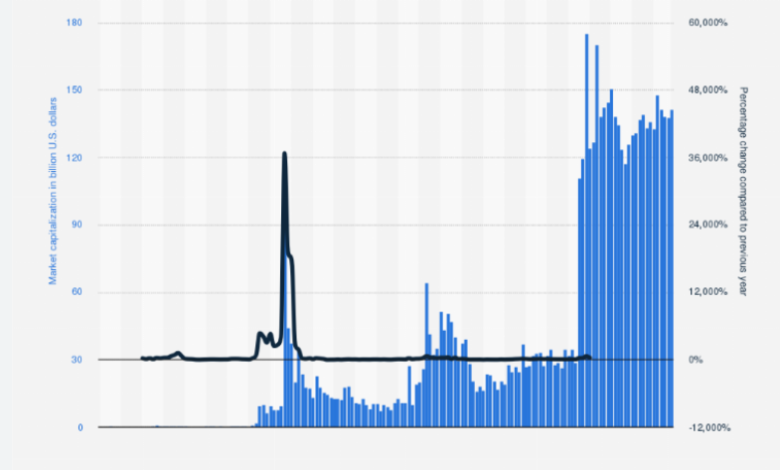

XRP’s market cap has fluctuated over the years, with significant price increases during bull markets and declines during bear markets. Understanding the correlation between market cap and price trends is key for investors seeking to predict future price movements and make informed decisions.

The Impact of XRP’s Market Capitalization on Investor Sentiment

Investors often view a cryptocurrency’s market capitalization as an indicator of its stability and potential for future growth. As XRP’s market cap grows, it is more likely to attract institutional investors looking for a more stable and established asset. These investors are more likely to hold XRP for the long term, contributing to a more predictable and sustainable increase in its price.

Conversely, a declining market cap can signal uncertainty, prompting investors to sell their holdings and reducing the overall value of XRP. Monitoring XRP’s market cap over time can help investors understand market trends and sentiment, ultimately influencing their investment strategies.

Factors Influencing XRP’s Market Capitalization

Several factors can directly or indirectly impact XRP’s market capitalization, including:

1. Adoption by Financial Institutions

Ripple’s strategic partnerships with major financial institutions, banks, and payment providers have contributed to an increase in XRP’s market cap. As more institutions use Ripple’s technology to settle cross-border transactions, the demand for XRP rises, driving up its price and market capitalization.

2. Regulatory Developments

Regulations have a significant impact on the value of XRP. Any positive or negative news regarding XRP’s legal status can influence investor sentiment. If XRP is deemed a security by regulators, it could result in negative pressure on its market cap, while favorable regulations may boost its value.

3. Technological Upgrades

Ripple’s continuous efforts to enhance the functionality of its network, such as the integration of the Interledger Protocol (ILP) and the development of new features, can increase the demand for XRP and thus positively impact its market cap.

4. Investor Speculation

Speculative trading often plays a significant role in driving XRP’s price. Traders looking to capitalize on price movements can lead to increased volatility, which can impact the market cap in both positive and negative directions.

Conclusion

XRP’s market capitalization is a vital indicator of its value in the market, but it is influenced by a wide range of factors, including demand, liquidity, regulatory changes, and investor sentiment. Understanding how these elements interact can provide valuable insights into the future price movements of XRP, particularly when viewed in relation to its price in USD and USDT.

While market capitalization plays a significant role in determining XRP’s price, it is important to stay informed about the broader trends in the cryptocurrency and financial industries. By keeping an eye on developments in the Ripple network and the adoption of XRP by financial institutions, investors can gain a clearer understanding of its potential for long-term growth.

Frequently Asked Questions (FAQ)

1. What determines the price of XRP?

The price of XRP is influenced by several factors, including demand, supply, market sentiment, and adoption by financial institutions. Additionally, market capitalization and liquidity play crucial roles in determining its price.

2. How does XRP market capitalization affect its price?

XRP’s market capitalization directly impacts its price by reflecting the total value of all circulating XRP tokens. A higher market cap typically correlates with a higher price due to increased demand and liquidity.

3. What is the difference between XRP price in USD and USDT?

XRP price in USD reflects its value in traditional fiat currency, while the XRP price in USDT is pegged to the value of the U.S. Dollar. USDT offers a more stable reference for price comparisons in the cryptocurrency market.

4. Can market capitalization predict XRP’s price?

While market capitalization is an important factor in understanding XRP’s value, it cannot predict price movements on its own. Other factors like market adoption, regulatory news, and investor sentiment play critical roles.

5. Is XRP a good investment?

XRP’s potential as an investment depends on several factors, including its adoption by financial institutions, regulatory status, and broader cryptocurrency market trends. Investors should carefully consider these factors before making investment decisions.

6. How can I track XRP’s market capitalization?

You can track XRP’s market capitalization on various cryptocurrency tracking platforms such as CoinMarketCap, CoinGecko, or through exchange platforms that list XRP.